marin county property tax exemptions

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Taxes and assessments section provides detailed information on new tax information exemptions and exclusions that are available and information on how to have your home or.

Property Tax Bills Mailed Tax Roll Nearly 973 Million

To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors.

. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization. To qualify for a low-income senior exemption for the Measure A parcel tax for a single-family residence you must. Overall there are three stages to real estate taxation.

Senior and Low Income Parcel Tax and Fee Exemptions APPLY NOW. If you are a person with a disability and require an accommodation to participate in a County. To qualify for a senior low-income exemption you must be 65 years or older by December 31 of the tax year own and occupy your residence located in the Special Tax Zone.

Veterans Exemption Veterans with a 100 disability due to a service-related. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. These are deducted from the assessed value to give.

In-depth Marin County CA Property Tax Information. The individual districts administer and grant. Exemptions are available in Marin County which may lower the propertys tax bill.

Owner must be 65 years old or older by. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities.

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. Time is short to submit applications for exemptions and discounts on an array of parcel taxes and.

The individual districts administer and grant these exemptions. Information on different types of tax exemptions available to property and business owners. Transfer tax in Marin County is a tax imposed by California counties and cities on the transfer of the title of real property from one person or entity to another within the.

Your property taxes would remain at 3500 instead of the new rate of. San Rafael California 94903. 415 499 7215 Phone 415 499 6542 Fax The Marin County Tax Assessors Office is.

3501 Civic Center Drive Suite 208. Establishing tax levies estimating property worth and then receiving the tax. Taxing units include city county governments and various.

For example the property taxes for the home that you have owned for many years may be 3500 per year. 1 be 65 years of age or older by December 31 2017 2.

Property Tax California H R Block

Marin County Certificate Of Trust Form California Deeds Com

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Clipping From Daily Independent Journal Newspapers Com

Tax Exempt Financing For 55 Fairfax Street San Rafael

Understanding California S Property Taxes

A Look At Marin County Ballot Measures Pacific Sun

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Marin Extends Moratorium On West Marin Short Term Rentals

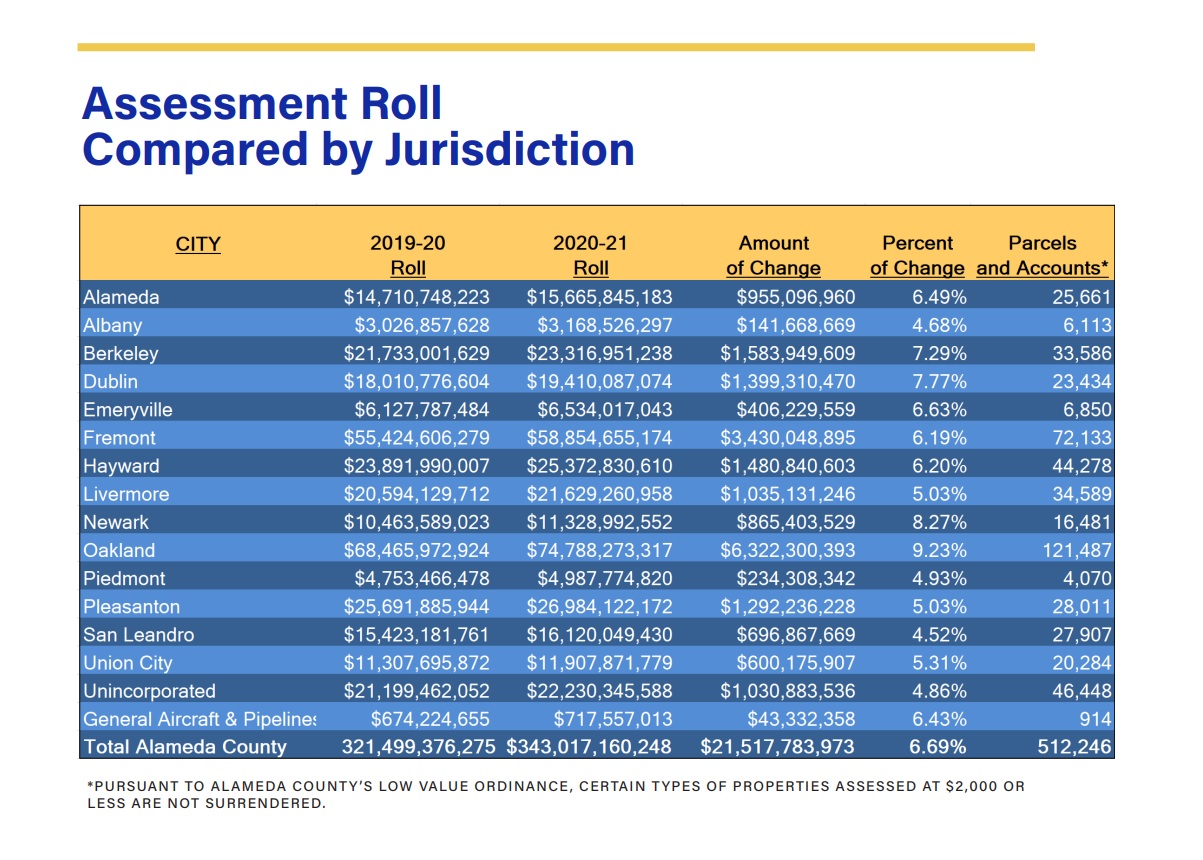

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Marin County Ceo Jordan Moss Finds Essential Housing For Those Being Left Behind

Parcel Tax Exemptions Marin County Free Library

Marin County Measure C The Wildfire Prevention Authority Parcel Tax

San Francisco County Ca Property Tax Search And Records Propertyshark

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates